Relationship between Financing sources and Balance Sheet of an enterprise (Part 1)

Bài đăng này đã không được cập nhật trong 4 năm

Raising finance is the first thing which a corporation has to do before launched, or before a business cycle. There are lots of way to classify financing methods, such as long term/short term, inside/outside sources,… This article supposes to consider finance classified into two sources, debt financing and equity financing, which relates closely to items in a Balance Sheet of a company. Moreover, Ho Chi Minh City Securities Corporation (HSC) will be picked as example for raising finance.

Equity Financing

Equity financing is the finance acquires from the shareholders and the investors. This is a long-term financial source for a corporation. Various sources of equity financing which are available to a corporation can come from its shareholders or its revenue after-tax. The company can mobilize finance through using different forms: formers’ fund, issuing shares, issuing right issues to existing shareholders or using the retained earnings.

1. Owners' Capital

The owners' capital is the initial financing sources of every organization. This will decide an enterprise's type.

SOE: initial capital allocated from the State budget

Joint-stock company: source formed from capital contribution of the shareholders

Private company: the initial capital of a few of owners

Joint ventures: initial capital from contributions of partners

Foreign companies: initial capital is 100% of foreign owner

2. Issuing Shares

The first time of issuing shares to public of a company is called IPO (Initial Public Offer). After IPO, company can issue more share for existing shareholders in case of it needs more fund for running business.

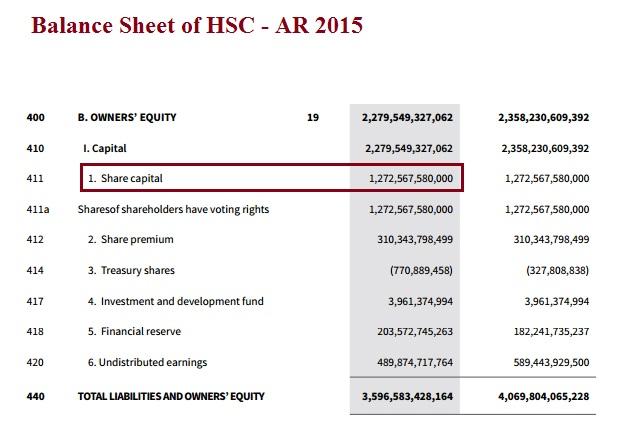

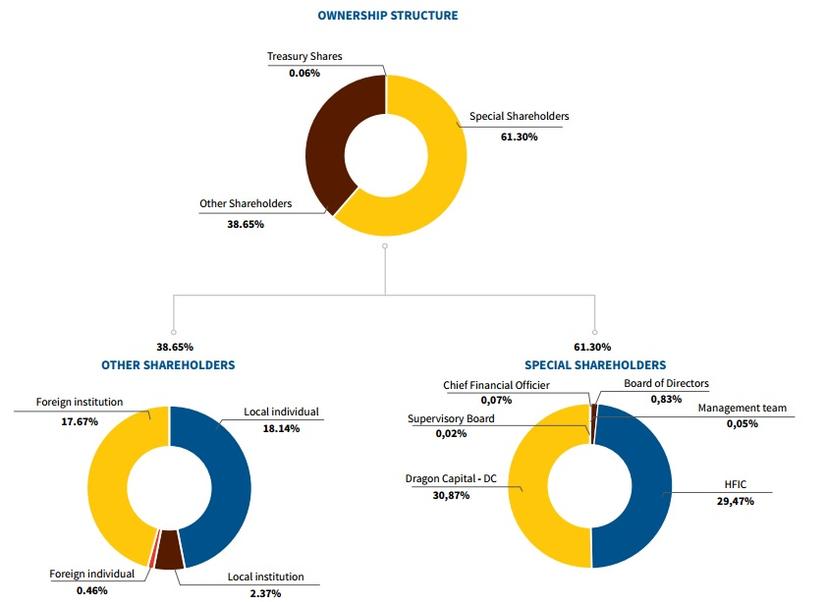

In case of HSC, the company issued common shares to raise a capital of 1,272,567,580,000 VND. Until the end of financial year 2015, the company had issued 127,256,758 common shares whose by both foreign and local investors, in which there are two big shareholders: Dragon Capital (30.87%) and HCMC Finance and Investment State-owned Company (HFIC) (29.47%). This is the shareholders can control decisions of HSC when the shareholder’s meeting is held, because the number of ordinary shares that a shareholder owns decides how many voting rights he/she/organization has, will influence to decisions of the company in shareholders’ meeting.

As you can see, the cash raised from issuing shares is noted as Share Capital item, included in Equity of Balance Sheet of HSC

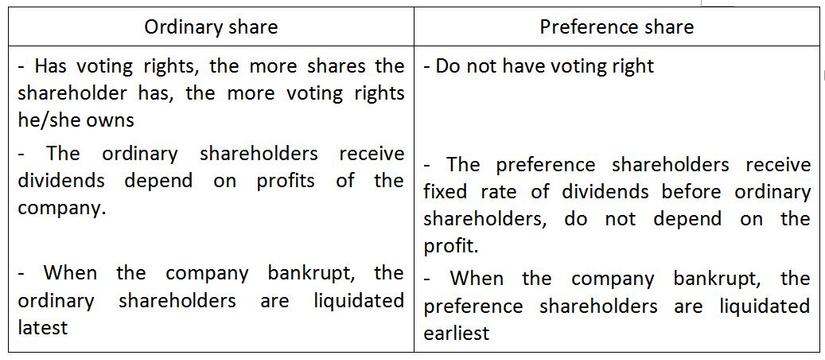

Besides, the company can issue another type of share, preference share. This two share types are described in the table below:

In fact, HSC and many corporations in Vietnam do not issue preference share. They only issue ordinary shares to shareholders to raise capital for their business. And the laws involve to issue shares in Vietnam are not complicated. When HSC want to issue new shares, the shareholders will make decision for this in shareholders’ meeting, and then the company needs to prepare a document to register with State Securities Commission of Vietnam. After 30 days, if the document is valid, the company will receive a certificate for share issue activity. Besides, with share issue, the risk of the company will be shared for its shareholders, that makes the company is safer when it has to face to bankruptcy. However, the control of the company is diluted when the percentage of ordinary shares owned by shareholders decreased because the number of ordinary shares increases and there are new shares sold for other investors, in this case the investors become shareholders of company and also have voting rights, it is possible for the owners loss the business ownership.

HSC also can raise finance with issuing right issues to existing shareholders. Rights issue means issuing rights to a company's existing shareholders to buy a proportional number of additional securities at a given price (usually at a discount) within a fixed period. Right issue is able to raise a large capital to the company. The number of right issues which a shareholder has will decide the number of additional shares which this shareholder can buy. And the shareholder will have more ownership if he/she gets more ordinary shares. When the company decides to issue right issues, it will send involved information to its shareholders. In the second quarter of 2011, HSC prepares to issue shares to existing shareholders with the ratio 3:2 (shareholder which owns three shares will have rights to buy two additional shares)

3. Retained Earnings

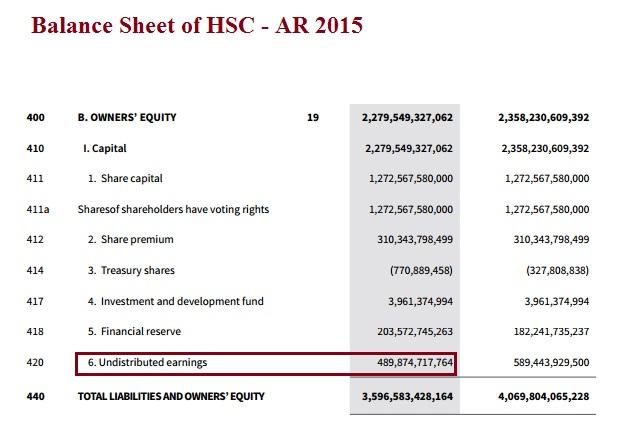

Another type of equity financing of HSC is retained earnings. Retained earnings refer to the portion of net income which is retained by the corporation rather than distributed to its owners as dividends. In 2015, HSC recorded a retained earnings of 489,874,717,764 VND, which is also an Equity item of Balance Sheet.

Decision of retaining or not is a sensitive debate in every organization. Less retained earnings, there will be more dividend paid for shareholders, however it might affect to financing balance. More retaining, investors could doubt the development potential of company. Like the case of Apple, decided to pay huge dividend to shareholders from 2012. Investors may question, whether Apple hold enough money for its business. However, in both case, retained earnings in particular, and equity financing in general, are important financing sources of every organization.

To be continued: Debt financing

All rights reserved