BREAKING NEWS: People withdrew their money from Silicon Valley Bank (SVB), causing it to fail.

Bài đăng này đã không được cập nhật trong 2 năm

I am confused....

Is anyone else facing the same problems as me? I have a savings account at a bank in Vietnam, but I don't know how to invest in stocks, buy property, or do anything else with my money besides saving it. I'm so busy that I don't have time to research these things.

Sometimes I want to learn how to play the stock market or invest in land, but besides not having the time, the daily news on TV about investment scams makes me very confused. It's really stressful because I have to work hard to make money, but then I'm afraid someone will take it away. If I don't make money, then I won't have any, so it's like the chicken and the egg.

BREAKING NEWS

The FDIC (Federal Deposit Insurance Corporation) took ownership of the bank's possessions on Friday. This caused worries that other banks could also experience difficulties.

Silicon Valley Bank (SVB), one of the most well-known lenders to technology start-ups, collapsed on Friday, leading the FDIC to take control of the bank. This is the second-largest bank failure in U.S. history and the largest since the financial crisis of 2008.

The FDIC now has control of nearly $175 billion in customer deposits. Although the sudden downfall of the bank has caused some to worry about a financial crisis, the Treasury Secretary has reassured investors that the banking system is still strong. The bank had been trying to find a buyer before its collapse, but was unsuccessful.

The failure of Silicon Valley Bank has caused other banks that cater to start-ups, such as First Republic, Signature Bank, and Western Alliance, to experience a drop in their stock prices.

The trading of shares of at least five banks was stopped multiple times throughout the day due to their sharp drops causing stock exchange volatility limits. On the other hand, the biggest banks seemed to be more protected from the consequences. After a decrease on Thursday, the stocks of JPMorgan, Wells Fargo, and Citigroup were generally stable on Friday.

This is because the biggest banks have stricter capital requirements and a much larger customer base than banks like Silicon Valley, which do not attract many retail customers. Regulators have also tried to prevent the big banks from concentrating too much in one area of business, and they have mostly stayed away from riskier assets such as cryptocurrencies.

Sheila Bair, the former chair of the FDIC, said that the large banks should not be affected by the issues surrounding Silicon Valley Bank. He added that since the largest banks are required to hold cash equivalents even against the safest forms of government debt, they should have plenty of liquidity.

Silicon Valley Bank had been a go-to lender for start-ups and their executives, but it invested a large share of customer deposits into long-dated Treasury bonds and mortgage bonds which promised modest, steady returns when interest rates were low.

However, when the Federal Reserve (FED) began to raise interest rates, the bank's holdings became less attractive and its clients began to withdraw more of their money.

Silicon Valley Bank recently lost nearly $2 billion when it was forced to sell some of its investments in order to pay redemption requests. This has caused investor worries about other regional banks, such as Signature Bank, First Republic Bank, and Western Alliance Bank. Silvergate Bank has also announced that it is shutting down its operations and liquidating after suffering heavy losses from its exposure to the cryptocurrency industry.

Some banking experts have suggested that the losses could have been avoided if parts of the Dodd-Frank financial-regulatory package, which was rolled back under President Trump, had not been changed. Greg Becker, the chief executive of Silicon Valley Bank, was a strong supporter of the change and was on the San Francisco Fed's board of directors, but is no longer on the board as of Friday.

At the end of 2016, Silicon Valley Bank had assets worth $45 billion. By the end of 2020, this had increased to more than $115 billion. On Friday, the FDIC took over the bank and created a new entity, the National Bank of Santa Clara, to hold the deposits and other assets of the failed one.

Customers with deposits of up to $250,000 will be fully reimbursed, but those with larger amounts may not get all of their money back. They will be given certificates for their uninsured funds, and will be among the first to be paid back with funds recovered while the F.D.I.C. holds Silicon Valley Bank in receivership.

When similar banks failed in 2008, large depositors only received 50 percent of their uninsured funds back. However, when Washington Mutual was bought by JPMorgan Chase, account holders were made whole.

Mình hy vọng bạn thích bài viết này và học thêm được điều gì đó mới.

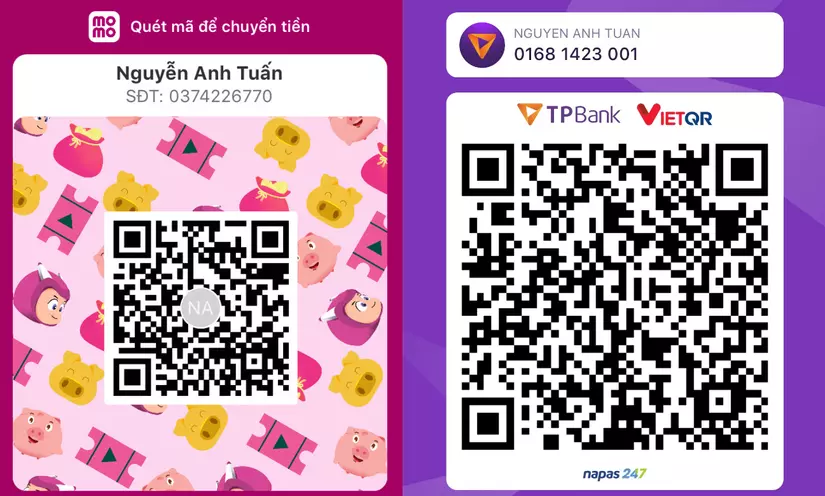

Donate mình một ly cafe hoặc 1 cây bút bi để mình có thêm động lực cho ra nhiều bài viết hay và chất lượng hơn trong tương lai nhé. À mà nếu bạn có bất kỳ câu hỏi nào thì đừng ngại comment hoặc liên hệ mình qua: Zalo - 0374226770 hoặc Facebook. Mình xin cảm ơn.

Momo: NGUYỄN ANH TUẤN - 0374226770

TPBank: NGUYỄN ANH TUẤN - 0374226770 (hoặc 01681423001)

All rights reserved