What happened? Comparing the Silicon Valley Bank Collapse to the 2008 Financial Crisis

Bài đăng này đã không được cập nhật trong 2 năm

Recently, there have been a lot of people talking about the collapse of Silicon Valley Bank and the terms they are using such as insured deposits, venture capital, and ripple effects on the economy can be confusing.

If you are confused, here is a clear and detailed explanation.

What happened in 2008?

For several years leading up to the 2008 financial crisis, some banks were making a lot of loans for commercial and consumer real estate, even to people with lower credit scores or other risk factors.

This was because the real estate market was booming and the value of the real estate was abnormally high. However, when the interest rates went up and the real estate values went down, many people and business owners could no longer afford their monthly payments, causing a problem for the banks who had done too many risky loans and had not kept enough money in their reserves to cover them.

What is a bank failure?

A bank failure occurs when the FDIC decides that a bank is no longer able to do business. This usually happens after the bank has been struggling for some time and the FDIC has told the bank to improve or raise more money.

Without warning, the FDIC will take over the bank and all its branches, and the bank will reopen on Monday either under new ownership or under the FDIC's control. The FDIC will try to find a buyer for the troubled bank in advance, usually another larger bank, so that the transition for customers is smoother. The buyer will get the bank's assets and customers for a much lower price than a typical merger or growing their own bank.

What are insured deposits?

In 1933, the FDIC was created to protect people's money in banks during the Great Depression, when around 4,000 banks failed. The FDIC provides insurance for deposits up to $250,000 per person, and banks pay for this insurance.

In recent years, there have been very few bank failures, with only four in 2020 and none in 2021.

What was special about SVB?

Banks decide which types of customers they want to work with, such as farmers, small businesses, or those looking for car loans. This is what makes them different from other banks.

Most banks have a mix of customers, but in 2008, many banks failed because they had too many real estate loans. SVB was a unique bank that specialized in tech and healthcare startups, which other banks may have seen as too risky.

At the time of its failure, it was the 16th largest bank in the US with assets of over $200 billion, but it only had 17 branches, compared to a similarly sized bank which would typically have hundreds of branches. SVB also had branches in other countries.

What has been going on in banking industry lately?

When the pandemic started in 2020, banks were worried that many of their borrowers would go bankrupt or businesses would close, leading to a lot of bad loans. However, thanks to government assistance, this did not happen. The Federal Reserve then lowered interest rates to stimulate the economy, which caused many people to refinance their mortgages.

But this caused a problem for banks, as customers were spending less and keeping more money in the bank, meaning banks had to find other ways to make money. The Fed then started raising interest rates again, and by early 2022, interest rates were near 4.5%.

What has been going on in technology industry, specifically?

During the pandemic, there was a huge increase in demand for tech services, e-commerce, remote work, and digital products and services. This caused tech companies to need more money to fuel their growth, so they turned to venture capital firms for funding. These firms gave tech companies large amounts of money, and the companies stored the money at SVB until they needed it.

What occurred at Silicon Valley Bank?

SVB had too much money in deposits, so they decided to invest it in Treasury securities. However, when the Federal Reserve began raising interest rates, the value of the securities decreased. At the same time, the tech industry was struggling and companies were withdrawing money from their accounts with SVB. To cover the losses, SVB had to sell the securities at a loss of $1.8 billion and raise $2 billion in capital.

What is a “bank run”?

If you’ve seen the movie It's a Wonderful Life, you might remember the scene where a lot of people line up at the Bailey Building and Loan and demand their money back. And George Bailey said:

You’re thinking of this place all wrong — as if I had the money back in a safe. The money’s not here. You’re money’s in Joe’s house, and the Kennedy house and Mrs. Macklin’s house, and a hundred others.

Banks usually work by taking deposits and using them to make loans. However, if everyone who has deposited money into the bank suddenly wants to take it out at the same time, the bank can become insolvent.

This is what happened to SVB. After they announced they were trying to raise capital, venture capitalists became worried and advised their tech companies to take out their money. This caused a lot of people to take out their money in a 48-hour timeframe, and the FDIC had to shut the bank down immediately to prevent it from becoming completely insolvent.

What will happen to the money that has been deposited into SVB accounts?

The FDIC has shut down Silicon Valley Bank and created a new bank called the Deposit Insurance National Bank of Santa Clara. Customers of SVB will only be able to access $250k of their money on Monday morning, the maximum guaranteed by the FDIC. Most SVB customers (>90%) had more than $250k in their accounts, so the FDIC will try to quickly find a buyer for SVB.

If a buyer is found, the transition will happen quickly and all deposit accounts of SVB will be assumed. If the FDIC can't find a buyer, it will sell the assets of SVB and pay back depositors that had balances above $250k, but this process could take years. In the meantime, many startups are facing cash flow problems as they cannot access any money above $250k.

What is the Dodd-Frank Act?

In 2008, after the financial crisis, Congress passed the Dodd-Frank Act which required banks with assets over $50 billion to submit to stress tests and have minimum capital requirements. In 2018, the threshold for these requirements was raised to $250 billion.

This was done to make sure that banks that were "too big to fail" were kept in check. Greg Becker, the former CEO of SVB, which was a $50 billion bank at the time, was an advocate for raising the threshold, which meant that SVB was no longer subject to the Dodd-Frank stress testing and capital requirements when it failed.

What are the major differences between 2008 and SVB?

The 2008 financial crisis and what happened at SVB were very different. The financial crisis was caused by banks making risky loans, while SVB failed because of a run on deposits.

SVB was more exposed to the tech industry, and the collapse happened very quickly because of the tech-savvy customers who spread the news quickly through social media and other channels. In contrast, the financial crisis was a slow buildup of bad loans over many months.

What other effects might happen?

People have been criticizing SVB on social media, saying that it is only for rich tech companies and venture capitalists. However, it was also a place for small startups. Now, with the tech world in a difficult situation, many tech companies are struggling and may not survive.

Some hedge funds are offering to buy accounts from SVB customers for less than the full amount. This could cause a ripple effect, with companies keeping their money in larger banks instead of smaller, regional banks. This could lead to fewer loans in the community, and further weaken the community banking system.

What are the implications of this for you?

Even if you don't work in tech or tech-related fields, the failure of Silicon Valley Bank could have a huge impact on the economy. It could mean that a lot of technology, such as healthcare technology and apps, will be lost.

The failure of more banks could also be devastating, as smaller banks are unable to compete with the big four. We should all be aware of the potential damage that SVB's failure could cause and work together to try and prevent it.

What action did the U.S. government take?

On Sunday, March 12th at 6:15 pm EST, the Treasury, the Fed, and the FDIC announced that they had taken action to protect all depositors at SVB, meaning that all account holders will have full access to their money on Monday morning. This was done by using a "systemic risk exception" to the $250k limit, which was used during the 2008 financial crisis to protect depositors.

No taxpayer money was used and the bank management team was fired, but the investors of SVB were not protected. The FDIC will use its reserves to cover any shortfall, and if there is a shortfall, all FDIC-insured banks will pay a "special assessment" to cover it. This was done to prevent a meltdown of the financial system and to protect the innocent bystanders of SVB's collapse.

Mình hy vọng bạn thích bài viết này và học thêm được điều gì đó mới.

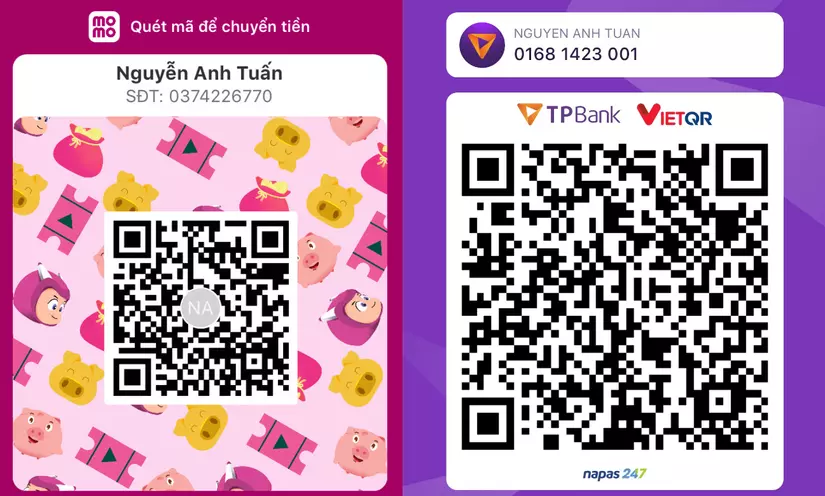

Donate mình một ly cafe hoặc 1 cây bút bi để mình có thêm động lực cho ra nhiều bài viết hay và chất lượng hơn trong tương lai nhé. À mà nếu bạn có bất kỳ câu hỏi nào thì đừng ngại comment hoặc liên hệ mình qua: Zalo - 0374226770 hoặc Facebook. Mình xin cảm ơn.

Momo: NGUYỄN ANH TUẤN - 0374226770

TPBank: NGUYỄN ANH TUẤN - 0374226770 (hoặc 01681423001)

All rights reserved